The smart Trick of Estate Planning Attorney That Nobody is Talking About

Table of ContentsNot known Facts About Estate Planning AttorneyThings about Estate Planning AttorneyNot known Details About Estate Planning Attorney Excitement About Estate Planning Attorney8 Easy Facts About Estate Planning Attorney Explained

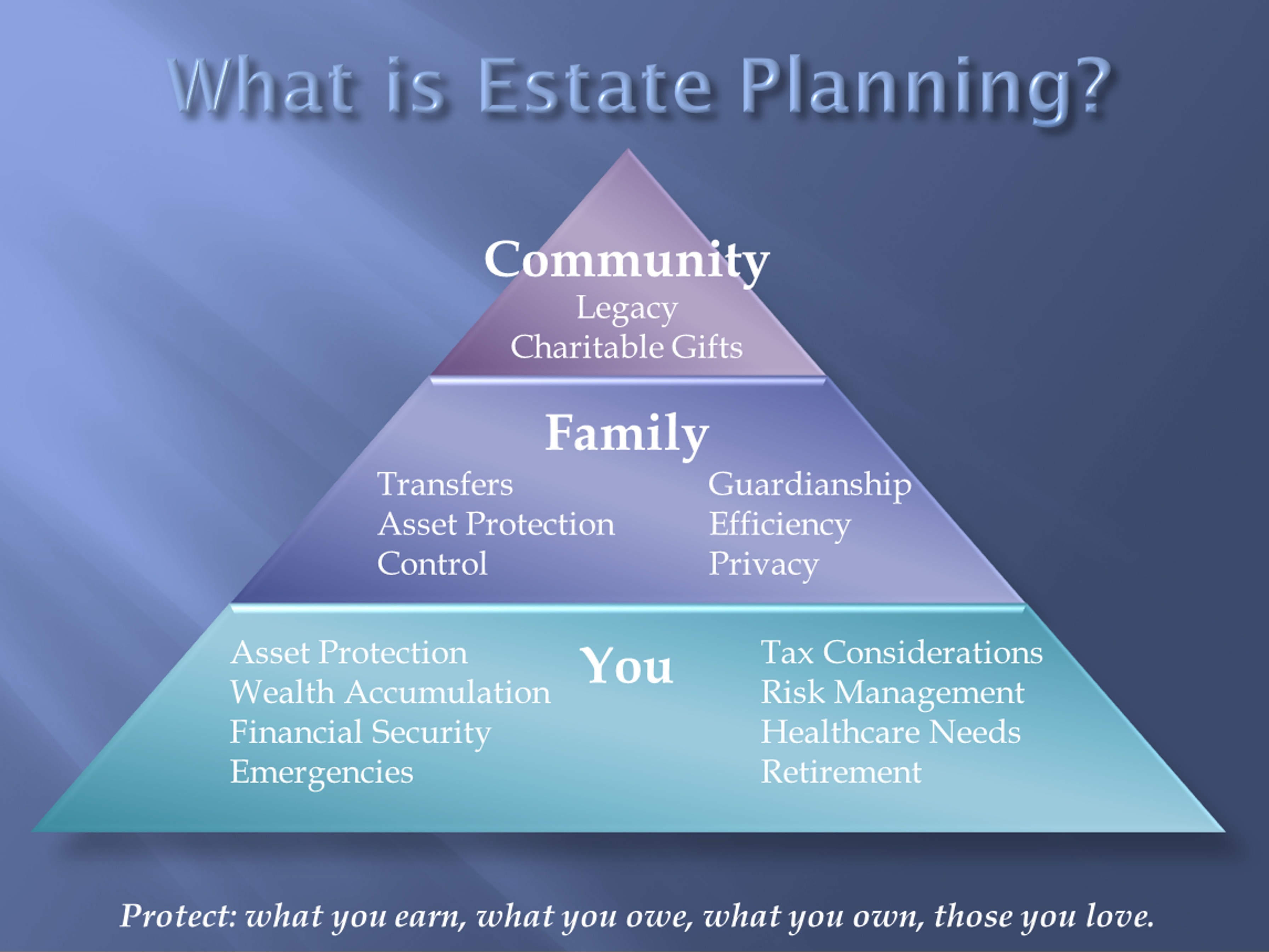

However that's our function, to generate the important, personal family details and financial info that we require so that we can best prepare the estate plan for the client. Makes great feeling, Richard. A great deal of excellent stuff there. Thanks for investing some time with me today. And we appreciate you being with us and you be well.Your estate is composed of all the properties you possess at the time of your death. These possessions can consist of: SecuritiesReal estateInterest in a businessPersonal propertyCashRetirement plans and IRAsLife insurance survivor benefit You function hard and very carefully plan to fulfill your lasting financial objectives, such as financing an education and learning, attending to your kids and saving for retirement.

When you develop a living trust fund, you have to bear in mind to transfer your properties into the trust fund. Possessions that are not in your trust, that do not have beneficiary designations or are not collectively titled with an additional person may still go through probate. You need to review the transfer of tax-deferred possessions, such as specific retired life accounts (Individual retirement accounts), Keoghs or pension, with your lawyer or accountant.

Estate Planning Attorney Fundamentals Explained

On top of that, probate is normally needed when an individual dies without a will (intestate). A trust fund is an estate planning device that defines how you would like your properties to be handled and dispersed to your recipients. It is a lawful paper that names a private or organization to handle the possessions placed in the depend on.

A living depend on is a collection of directions laying out exactly how you desire your possessions to be managed and distributed to you and your recipients. Estate Planning Attorney. When you develop a living trust fund, you register your possessions to the count on, and the count on comes to be the proprietor of the possessions, yet you maintain total control

A Testamentary Depend on is created in a will and is only valid after the probate process is completed. A Charitable Remainder Count on is a tax-exempt, irrevocable trust fund that enables a donor to make an existing gift of cash money or valued assets to a trust while obtaining a revenue stream from the depend on for his or her life.

Fascination About Estate Planning Attorney

The count on may offer an existing earnings tax obligation reduction, flexibility to offer properties without immediate capital gains awareness, and possibility for decreasing or eliminating estate tax obligations. After an attorney has established your count on, money and/or appreciated possessions can be transferred into the count on. The count on might name you and your partner as revenue beneficiaries, which means you will certainly obtain income throughout of your lives, or for a regard to years.

If you offered your appreciated property outright, you would certainly pay a tax on the funding gain you identified from the sale. If the Philanthropic Remainder Trust fund offers a valued property, no resources obtains taxes are owed back then. Because of this, more cash is readily available for reinvestment inside the count on than would be if the property was marketed outright.

These depends on are intricate and should be carefully administered to make certain optimal income and estate tax advantages (Estate Planning Attorney). The Edward Jones Depend on Firm can deal with the administration of properties, as well as recurring management and reporting. If you decide to act as your very own trustee, you take single check this site out obligation for ongoing administration of the depend on, which is a significant obligation

The Best Guide To Estate Planning Attorney

Planning for the end of life can be an emotional and demanding procedure, however having an estate plan in place can reduce some of the unpredictability and stress and anxiety, outlining guidelines for your treatment in case of your incapacity and avoiding familial fights upon your passing away. Estate Planning Attorney. From powers of attorney to buy-sell contracts to wills and counts on, there are lots of devices and many considerations to be thought about when preparing your Florida estate

In addition, for a will to be legitimate, the testator should be of sound mind. An attorney can guarantee that your will certainly includes the provisions you desire and that it is validly performed. Get in touch with our Tampa estate preparation, wills and trusts attorney today to learn more. A trust fund is a partnership in between a settlor, a trustee, and a recipient.

The trustee then takes care of the assets for the advantage of the beneficiary, according to standards set out in the depend on. Relying on the kind of trust, a trust can be used to: Minimize tax obligation liability; Safeguard assets from lenders; Manage money for vibrant, disabled, or irresponsible visite site relative; and Stay clear of probate.

Estate Planning Attorney Fundamentals Explained

The individual agent has the duty to make certain that all beneficiaries obtain clean title to the possessions they inherit. Probate is an intricate procedure, with numerous actions and requirements. A Tampa fl probate attorney can encourage the individual rep of an estate on how internet to proceed in the probate procedure and can assist to retitle possessions and make sure clean title.